lake county real estate taxes covid 19

The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. Obtain an estimate of redemption from the County Clerks Office.

Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022.

. Total household income for calendar year 2021 must be at or below 80 of the area median income for Lake County as follows. Physical Address 18 N County Street Room 102 Waukegan IL 60085. Return to Work - Worksite Prevention Protocol.

SECOND INSTALLMENT OF REAL PROPERTY TAXES ARE DUE FEBRUARY 1 2022 AND WILL BE DELINQUENT IF NOT PAID BY. Find out how to obtain a second copy of your tax bill if you have misplaced or not received your current tax bill. 847-377-2000 Quick Links Assessors Office Board of Review County Clerks Office Recorder of Deeds Treasurers Office Prior Years Tax.

Property Tax Please allow 2-3 business days for your online payment to post. Delinquent Taxes Prior Years Sold. Providing some form of taxpayer relief from the economic fallout of the COVID-19 pandemic has been.

The county has created a process by which a Lake County property owner who has been financially impacted by the coronavirus emergency may apply for a penalty waiver after the April 10 deadline. 3 penalty interest added per State Statute. Mailed payments must be postmarked no later than April 11 2022.

Household Size Qualifying Income 1 42750 2 48850 3 54950 4 61050 5 65950 6 70850 7 75750 8 80600 9 85424 10 90077 RESTRICTIONS 1 Landlords may not live in the same unit as tenant s. LAKE COUNTY Calif. Half Of Property Tax Payments Deferred By 60 Days In Lake County Jonah Meadows May 13 2020 1121 AM 9 min read WAUKEGAN IL A divided Lake County board voted Tuesday to extend property tax.

Property tax bills mailed. The lake county community economic development department will hold a public hearing on the preparation of its one-year 2022 annual action plan at 400 pm on monday june 13th 2022 in the lake county community economic development department office at the lake county government complex located at 2293 north main street room a-310 crown point. The first installment of property tax bills is due on.

Payments over the phone and online have a transaction limit of 100K. Zillow has 1938 homes for sale. 18 N County Street Waukegan IL 60085 Phone.

Protecting the Public and Our Employees Return to Work - Worksite Prevention Protocol NOTICE SECOND INSTALLMENT OF REAL PROPERTY TAXES ARE DUE FEBRUARY 1 2022 AND WILL BE DELINQUENT IF NOT PAID BY APRIL 11 2022. Lake County Treasurer Lorraine Fende and Lake County Auditor Christopher Galloway announced this week the process for taxpayers who are experiencing financial difficulties due to the novel. Protecting the Public and Our Employees.

There is a convenience fee of 25 for creditdebit card payments or a 300 flat fee for an e-Check. Real Estate Tax Calendar. Call Forte Customer Service at 866 290-5400 and press option 4.

Have a copy of your tax return handy for example to file for 2021 you will need a copy of your 2020 tax return Go to the Chief County Assessment Office Smart E-Filing Portal at assessorlakecountyilgov Log in to your account create a new account or log in as a guest Click Available Filings. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. There is a PIN limit of 10 parcels per transaction.

Instead of the usual two installments taxpayers will be able to spread their payments over four installments without having to pay late fees. Payments that are mailed must have a postmark of Wednesday February 16 2022 or before by the United States Postal Service only. CHICAGO WLS -- Property taxes.

What if I am unable to make a full property tax payment by. Property taxes will not incur interest penalties if all payments are made on their due dates as follows. To start the application process.

The penalty waiver process requires documentation as to how taxpayer was impacted by the virus such as reduced hours layoffs business closure hospitalization or other circumstances that. The county of Lake and the cities of Clearlake and Lakeport are gauging the potential impacts of a gubernatorial directive issued last week that allows a short-term deferral of sales and use taxes to local governments. 1st installment due date.

A blanket decrease in property values would have little effect on tax bills without a decrease in the amount of taxes collected by the governments Dixon said. United Way of Lake County announced today that 84345 has been awarded in the ninth and final round of Lake County COVID-19 Response. The Cook County Treasurers Office typically deals with about 200 million in late payments at this time of the year but this year theyre waiting on 230 million.

Pay online at httptaxlakecountycagov or by telephone 866 506-8035. Lake County taxpayers can defer half their property tax payments for 60 days under a measure approved Tuesday to provide residents with some economic breathing room. The county expects about 10 of the roughly 300000 property taxpayers would apply for a deferral.

Last week among a number of measures meant to help address the economic fallout from COVID-19 Gov. Last day to submit changes for ACH withdrawals for the 1st installment. Lake County The Lake County Board passed an ordinance extending the delinquency date of 50 of both the first and second installments of 2019 property taxes by 60 days after each installment due date in 2020.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. 2021 Real Estate Tax Calendar payable in 2022 May 2nd. 15 penalty interest added per State Statute.

Covid 19 Data Fond Du Lac County

Fond Du Lac County Health Department Fchd Covid 19 Vaccination Clinics Fond Du Lac County

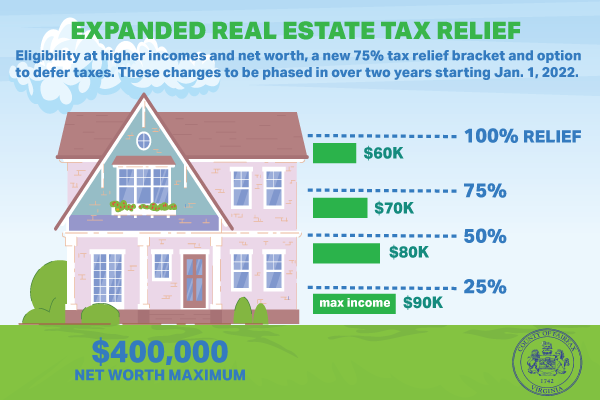

Board Of Supervisors Expands Real Estate Tax Relief Program News Center

Lake View Township Valuation Reports 2021 Cook County Assessor S Office

The Cook County Property Tax System Cook County Assessor S Office

Real Estate And Tax Data Search Fond Du Lac County

Mclennan County Covid 19 Updates Mclennan County Tx

About The Cook County Assessor S Office Cook County Assessor S Office

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

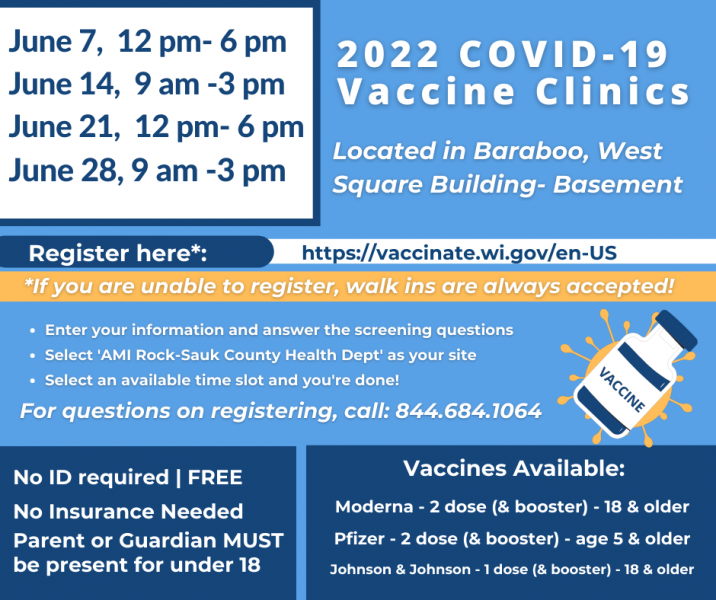

Covid 19 Vaccination Sites Sauk County Wisconsin Official Website

.jpg)